Navigating the financial world with bad credit can feel like sailing through stormy seas without a compass. It’s a challenge that millions face, yet it’s one that’s often misunderstood and fraught with pitfalls. This article seeks to shed light on the murky waters of bad credit finance, offering guidance for those who find themselves in this predicament.

Bad Credit Finance

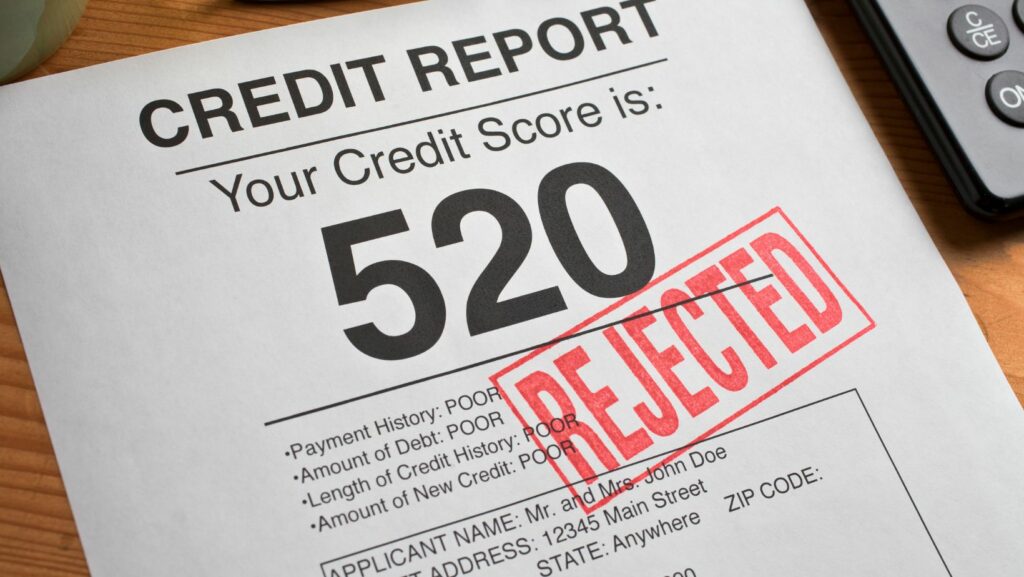

Understanding bad credit finance depends primarily on grasping two concepts: the nature of bad credit and its impact on one’s financial options. Bad credit originates from missed payments on credit cards, loans, or mortgages, often indicating to lenders a history of financial instability. It’s scored primarily on a scale from 300 to 850 by major credit rating agencies like FICO and VantageScore. A score under 580 represents bad credit according to FICO, while for VantageScore, anything under 600 falls into this category.

Bad credit’s impact on one’s financial options is significant. Lenders view it as a risk and may choose not to provide loans or offer them at high-interest rates. Credit cards for individuals with bad credit also tend to charge high fees and rates, further limiting financial choices. Despite these difficulties, understanding bad credit finance means recognizing it’s not a life sentence but a temporary challenge that can be overcome with strategic financial management. Good financial habits, like timely repayments and spending within means, allow for gradual improvements in the credit score over time. Conquering the bad credit issue involves a committed path to financial discipline.

Bad credit’s impact on one’s financial options is significant. Lenders view it as a risk and may choose not to provide loans or offer them at high-interest rates. Credit cards for individuals with bad credit also tend to charge high fees and rates, further limiting financial choices. Despite these difficulties, understanding bad credit finance means recognizing it’s not a life sentence but a temporary challenge that can be overcome with strategic financial management. Good financial habits, like timely repayments and spending within means, allow for gradual improvements in the credit score over time. Conquering the bad credit issue involves a committed path to financial discipline.

What Is Bad Credit?

Bad credit refers to a poor record of managing and repaying borrowed money. This record, represented by an individual’s credit score, is compiled by credit bureaus and used by lenders to assess the risk of lending. Credit scores typically range from 300 to 850.

Bad credit often surfaces from missed or late credit account payments. However, it also stems from situations such as bankruptcy, foreclosure, or high utilization of credit balance, imprints that tarnish the credit report from three to ten years. Predicaments like these significantly stain an individual’s borrowing reputation, swaying away lenders and credit issuers with a perception of high risk.

However, bad credit doesn’t equate to a financial dead-end. It’s a snag, albeit tough, that can be overhauled by strategic methods, a journey that brings a sense of financial resilience and stability.

Types of Bad Credit Finance Solutions

In the endeavor to overcome the hurdles of bad credit, multiple finance solutions present themselves. Some, including secured personal loans, offer financial support by enabling borrowers to secure loans with assets such as homes or automobiles. Examples like these highlight that despite poor credit history, options for financial restoration exist. Credit unions, known for their agile lending policies, offer another route towards credit rehabilitation. These non-profit organizations provide loans even to members with poor credit scores. Finally, online lenders, though they operate on high interest rates, are platforms that could deliver loans for borrowers boxed in by bad credit. These online institutions base their loan approval on aspects beyond credit scores such as income sources and job history. Thus, no singular path leads to the fortification of creditworthiness; it spawns from a blend of strategies optimized for a individual’s unique financial circumstance.

In the endeavor to overcome the hurdles of bad credit, multiple finance solutions present themselves. Some, including secured personal loans, offer financial support by enabling borrowers to secure loans with assets such as homes or automobiles. Examples like these highlight that despite poor credit history, options for financial restoration exist. Credit unions, known for their agile lending policies, offer another route towards credit rehabilitation. These non-profit organizations provide loans even to members with poor credit scores. Finally, online lenders, though they operate on high interest rates, are platforms that could deliver loans for borrowers boxed in by bad credit. These online institutions base their loan approval on aspects beyond credit scores such as income sources and job history. Thus, no singular path leads to the fortification of creditworthiness; it spawns from a blend of strategies optimized for a individual’s unique financial circumstance.

Navigating the World of Bad Credit Lenders

It’s clear that bad credit can make financial management seem like a daunting task. However, it’s not a life sentence. With strategic financial practices and responsible spending, it’s possible to navigate the stormy seas and improve your creditworthiness. There’s a range of options available for those with bad credit, from secured personal loans and flexible credit unions to online lenders who look beyond just your credit score. Remember, every individual’s financial situation is unique, so it’s essential to find a solution tailored to your needs. Bad credit might be a hurdle, but with the right approach and tools, it’s a hurdle that can be overcome. Keep pushing forward, and you’ll soon find your financial footing again.